Disadvantages of wine investment

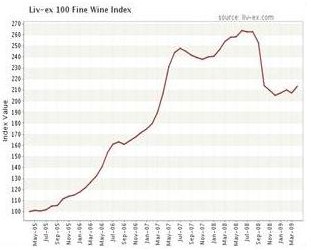

When the wine investment market isn't moving uniformly upwards as it did from 2006 to 2008, it becomes much more of stock picker's market, which generally requires a great deal of expertise, understanding and knowledge. In other words it's very easy to make some expensive mistakes unless you know what you are doing. For instance, at the end of 2008, virtually every Bordeaux chateau and vintage dropped significantly in value. Some 2005s dropped by more than 25% in value in the course of two months.

Clearly, therefore wine prices can go down as well as up. Even as the market is generally moving up, particular wines will certainly move down. Equally, the converse is true. Therefore, when wine prices are generally moving down, cash rich investors will be eyeing the market with a view to picking up some great deals. Once the market has bottomed out, that is the time go back in and buy. Timing is all. There are no dividend payments that accrue from wine investment. Moreover, there are the costs of storage and selling which have to be factored in. Both eat into profitability.

Typically, a broker will work on a 10% margin when you come to sell your wine. If you are selling at auction, there are also consignor fees to consider. These generally depend on the quantity and quality of wine on offer.

The higher the value of the wine, the lower the fee. The storage costs of keeping your wine under bond with a professional storage company or merchant also vary but usually cost around £7-10/case per annum. If you have smaller parcels of wine to sell or even mixed cases, you might want to consider selling on www.bidforwine.com which has very attractive commission rates for buyers and sellers.

Some fine wines and primeur wine may not turn out to as good as initially predicted. Once in bottle , wines are frequently re-rated. A negative re-assessment by Parker whereby a wine drops from 98 points to 94 may well result in a fall in value. Others though may experience the opposite effect in being up-rated. This invariably has a windfall effect of increasing the value quickly and, at times, dramatically.