Compare Market

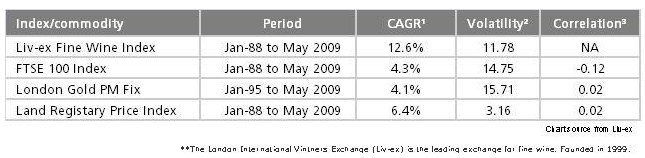

We measured returns by comparing thecompound annual growth rate (CAGR)of all four assets classes since January 1988. Volatility was compared by looking at each series’ annualised standard deviation over the same period. We then used this data to analyse the correlation shown by equities, property and gold with wine .In order to test this, we looked at a number of popular investments – equities, property and gold – and analysed their performance using the criteria above. We then compared this to the same measures in relation to the Liv-ex 100 Fine Wine Index**. Each of our asset classes is represented by an accepted benchmark – the FTSE 100 Index, the Halifax House Price Index, and the London PM Gold Fix, respectively – all priced in GBP.

As you can see in the table below, wine shows the highest CAGR of all the assets listed, at more than twice the level of its nearest competitor, property. It also shows the second lowest volatility,behind only property. Moreover, wine shows a tiny positive correlation with equities over our 20 year period, and a similarly small negative correlation with property and gold.