Wine Investment loans

Dfr offer 7% growth tax free investment ,starting from £20.00 !!

Loan company to use wine as sole collateral

- Tuesday 1 November 2011

- by Adam Lechmere

- Comments

An asset management company is offering what it claims are the world's first pure wine investment loans.

Grange vertical: loan to buy

Loan Against, an arm of Prestige Asset Finance, is offering loans of up to 70% of the value of blue-chip wines, with no other collateral required.

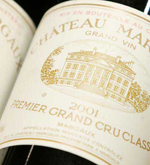

According to the company this is ‘the world’s first non-recourse, non-status wine investment loan, enabling private investors to [Bordeaux] buy premier crus…and other wines of distinction…’

Managing director James Constantinou said, ‘We create instant liquidity for UK and offshore-based investors who are looking to acquire fine wine at auction or through private sale.’

Spokesman Mark Fielding said the system is unique for wine because it requires no credit check, and money is advanced using the wine as sole collateral.

Loan Against will provide tax-deductible loans of between £100,000 and £10m for purchases of wines including Bordeaux First Growths, super seconds, top Right Bank wines, Sauternes, top Burgundies, Penfold’s Grange and other blue chip properties.

Loan Against, an arm of Prestige Asset Finance, is offering loans of up to 70% of the value of blue-chip wines, with no other collateral required.

According to the company this is ‘the world’s first non-recourse, non-status wine investment loan, enabling private investors to [Bordeaux] buy premier crus…and other wines of distinction…’

Managing director James Constantinou said, ‘We create instant liquidity for UK and offshore-based investors who are looking to acquire fine wine at auction or through private sale.’

Spokesman Mark Fielding said the system is unique for wine because it requires no credit check, and money is advanced using the wine as sole collateral.

Loan Against will provide tax-deductible loans of between £100,000 and £10m for purchases of wines including Bordeaux First Growths, super seconds, top Right Bank wines, Sauternes, top Burgundies, Penfold’s Grange and other blue chip properties.

Loans against en primeur wines are not possible at the moment due to the ‘risky’ nature of that market, but it is something that ‘might be entertained in the future’.

At the moment, Fielding said, the company is looking to loan a private buyer £100,000 for a complete vertical of Grange, 1951-2006.

Rates start at 2.49% per month, payable at the end of seven months.